[ad_1]

Regional Banks and debt ceiling drama

In per week full of ups and downs, small US banks had been doing properly whereas the nation was on the sting of a giant cash downside referred to as the ‘debt ceiling disaster.’

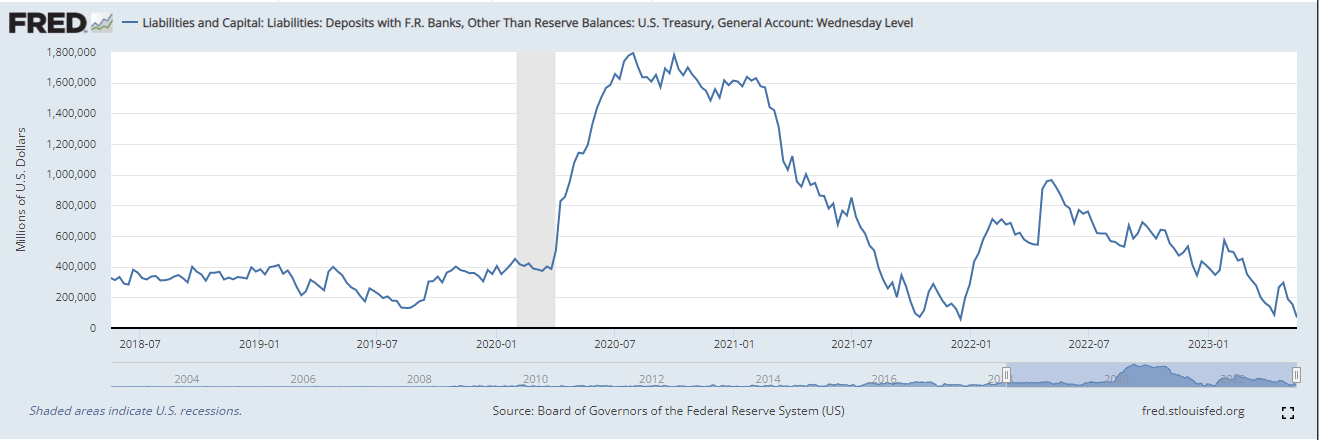

The US authorities’s financial savings on the Federal Reserve took a giant hit, dropping by $53bn on Monday to simply $87bn, which could be very near the bottom level it hit earlier than the tax funds in April.

Because the week went on, the cash within the authorities’s account dropped much more to $57 billion after a lower of $11 billion on Could 19.

Nonetheless, the excellent news is that individuals’s belief within the banking sector appears to be rising for now. A well-liked bank-related inventory market fund (KRE ETF) jumped by over 5.0% on the week, boosted by the $2bn enhance in deposits at Western Alliance Financial institution, based on MacroScope.

Japan inflation woes

In the midst of all this, President Biden went to a G7 assembly in Japan, the place prime leaders have been having powerful discussions. They’re looking for a solution to remedy this cash downside with out making the US authorities default (or fail to pay its debt).

On the similar time, Japan is coping with inflation, which is when costs of issues go up – it’s now over 4%, the very best in 40 years.

Confusion on the UK’s Central Financial institution

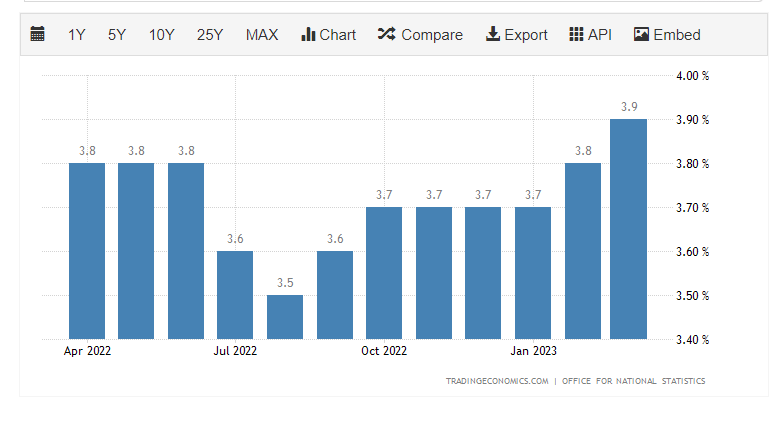

Throughout the ocean, the top of the Financial institution of England (BoE), Governor Bailey, has been making an attempt to handle excessive inflation, or rising costs, within the UK. He’s nonetheless targeted on maintaining inflation at 2%, however he says these are uncommon occasions, and that’s why inflation is within the double digits proper now.

Bailey believes that when power prices begin happening, inflation will too. Individuals watching the markets aren’t certain what to suppose, and so they’re predicting one to 2 extra small will increase in rates of interest this 12 months.

In different UK information, wages are nonetheless rising sturdy, despite the fact that corporations will not be hiring as a lot. Individuals who work for the federal government noticed their pay go up by 5.6%, a excessive level in 20 years, whereas individuals in personal corporations additionally noticed an honest enhance of seven%. Unemployment rose slightly bit to three.9%, however extra individuals are actively searching for jobs. On the flip aspect, there are fewer job openings now, based on MacroScope.

Housing Market Cooling Down within the US

Within the U.S., knowledge exhibits that extra new properties are being offered, however fewer current properties. Individuals who have 30-year mortgages with 3% rates of interest are selecting to maintain their properties. So, there are fewer outdated properties on the market, whereas new properties are being offered with the assistance of lower-cost mortgages and reductions. The variety of individuals making use of for mortgages to purchase properties has dropped 26% in comparison with final 12 months, based on MacroScope.

Blended Information from China

In China, the financial development in April was lower than anticipated. Manufacturing facility manufacturing solely grew 5.6% in comparison with final 12 months, as an alternative of the expected 10.9%. Equally, retail gross sales and funding in issues like buildings and infrastructure additionally fell wanting predictions. Nonetheless, there was some excellent news. The unemployment price dropped to five.2%, and extra properties had been offered in comparison with the identical interval final 12 months, based on MacroScope.

Abstract

In abstract, as this macroeconomic saga unfolds throughout the globe, monetary resilience and strategic adaptability stay on the core of those dynamic markets. From the corridors of regional banks to the BoE’s chambers and the center of Asian economies, the long run lies in each the refined nuances and the grand narratives of worldwide financial exercise.

[ad_2]