[ad_1]

Fast Take

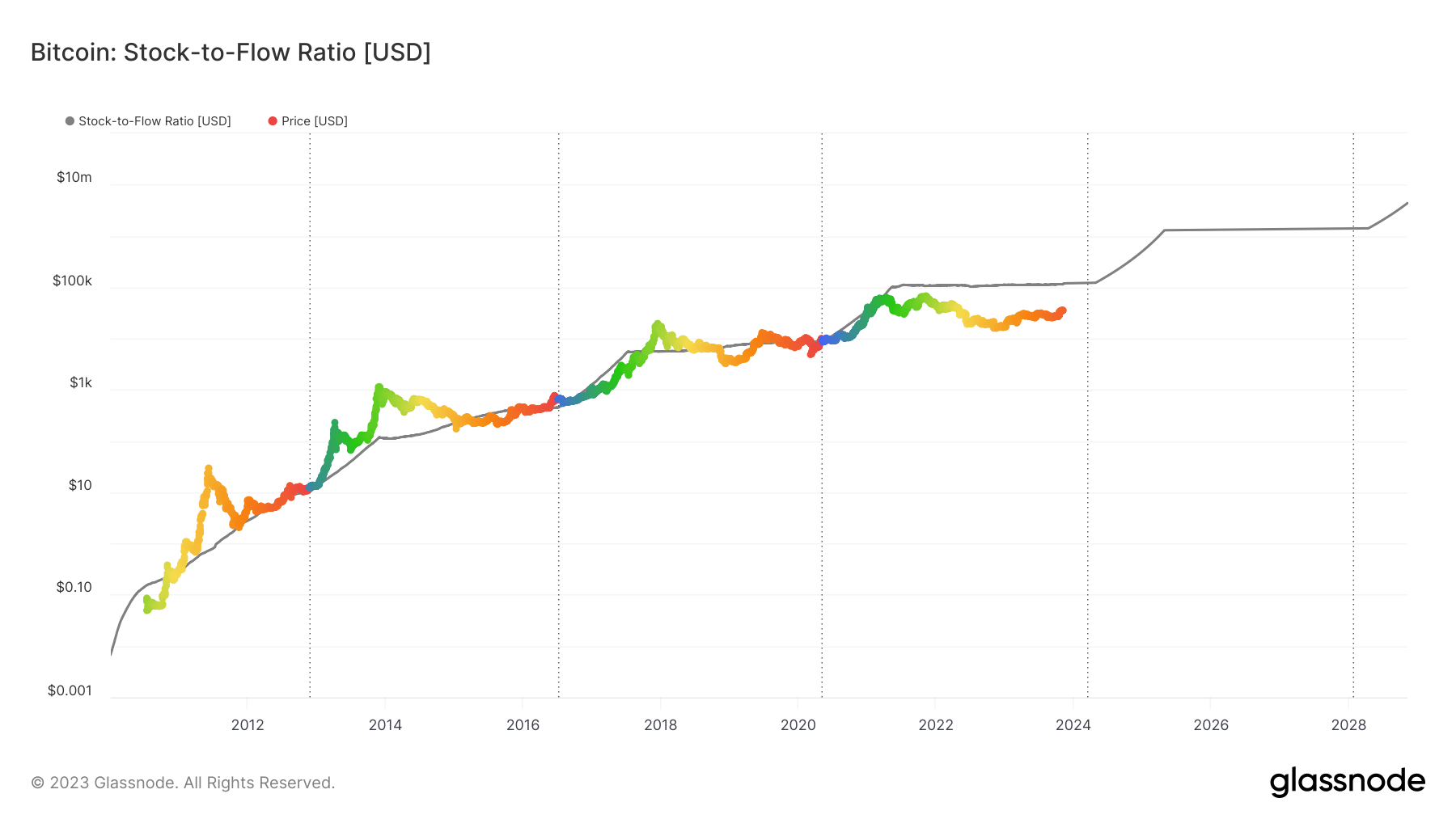

Bitcoin’s Inventory-to-Circulation (S/F) Ratio, a mannequin constructed on the premise that shortage fuels worth, seems to be regaining its predictive drive.

Traditionally, Bitcoin’s worth has moved in tandem with the S/F ratio, making it a probably great tool for predicting future valuations.

Nevertheless, the mannequin deviated from predictions round April 2021, throughout the bull market run. Apparently, with the halving 5 months away, Bitcoin’s trajectory appears to have realigned with the S/F ratio. Though nonetheless $65,000 in need of the mannequin’s prediction, the pattern signifies a constructive course.

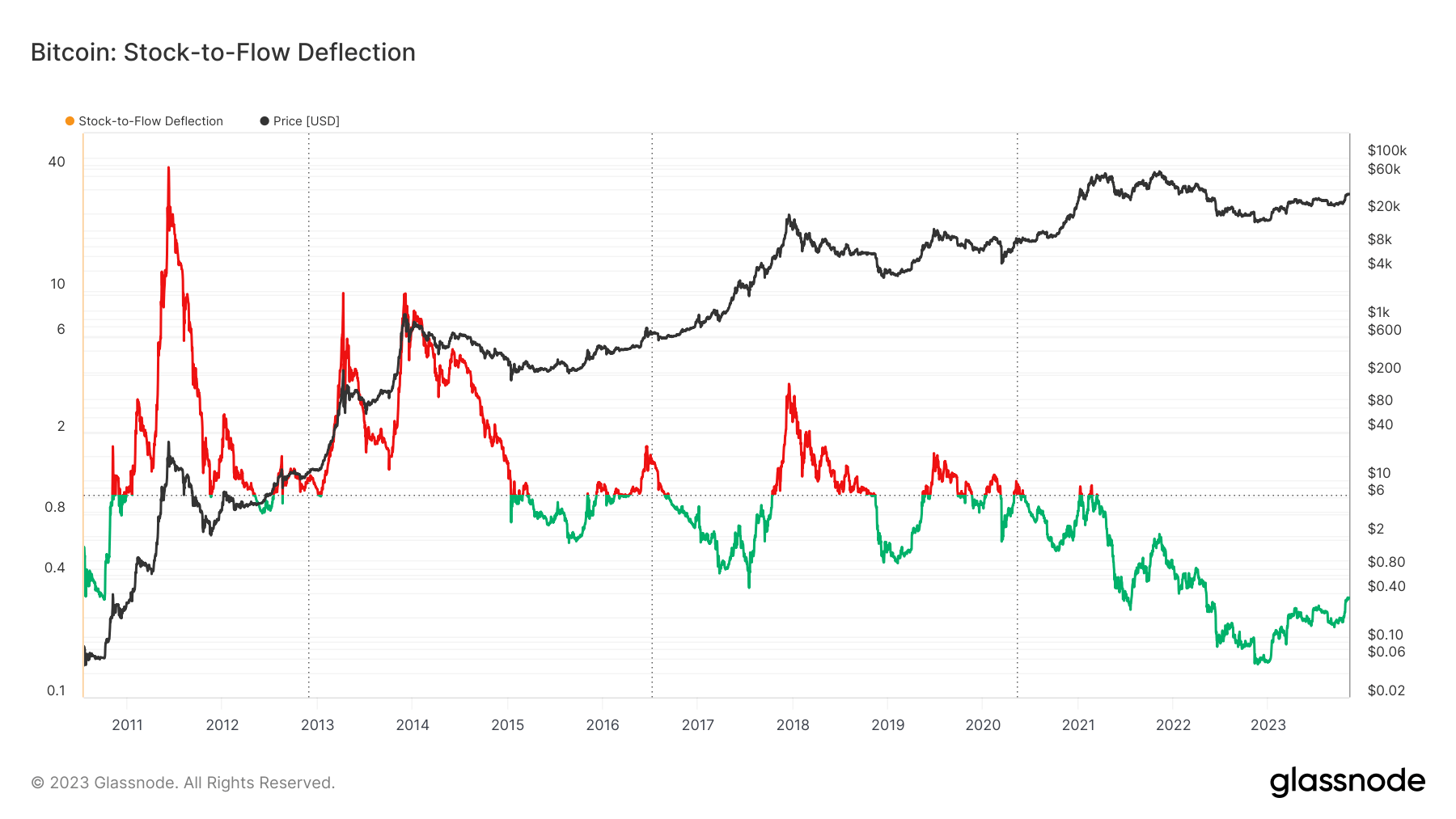

The S/F deflection, measuring the divergence between the present Bitcoin worth and the S/F mannequin, suggests Bitcoin continues to be considerably undervalued. That is based mostly on the mannequin’s assumption {that a} deflection higher than or equal to 1 signifies Bitcoin is overvalued and vice versa. Notably, the one time Bitcoin was deemed extra undervalued in response to this mannequin was throughout the FTX collapse in 2022.

The submit Bitcoin’s shortage mannequin hints at huge undervaluation appeared first on CryptoSlate.

[ad_2]