[ad_1]

Fast Take

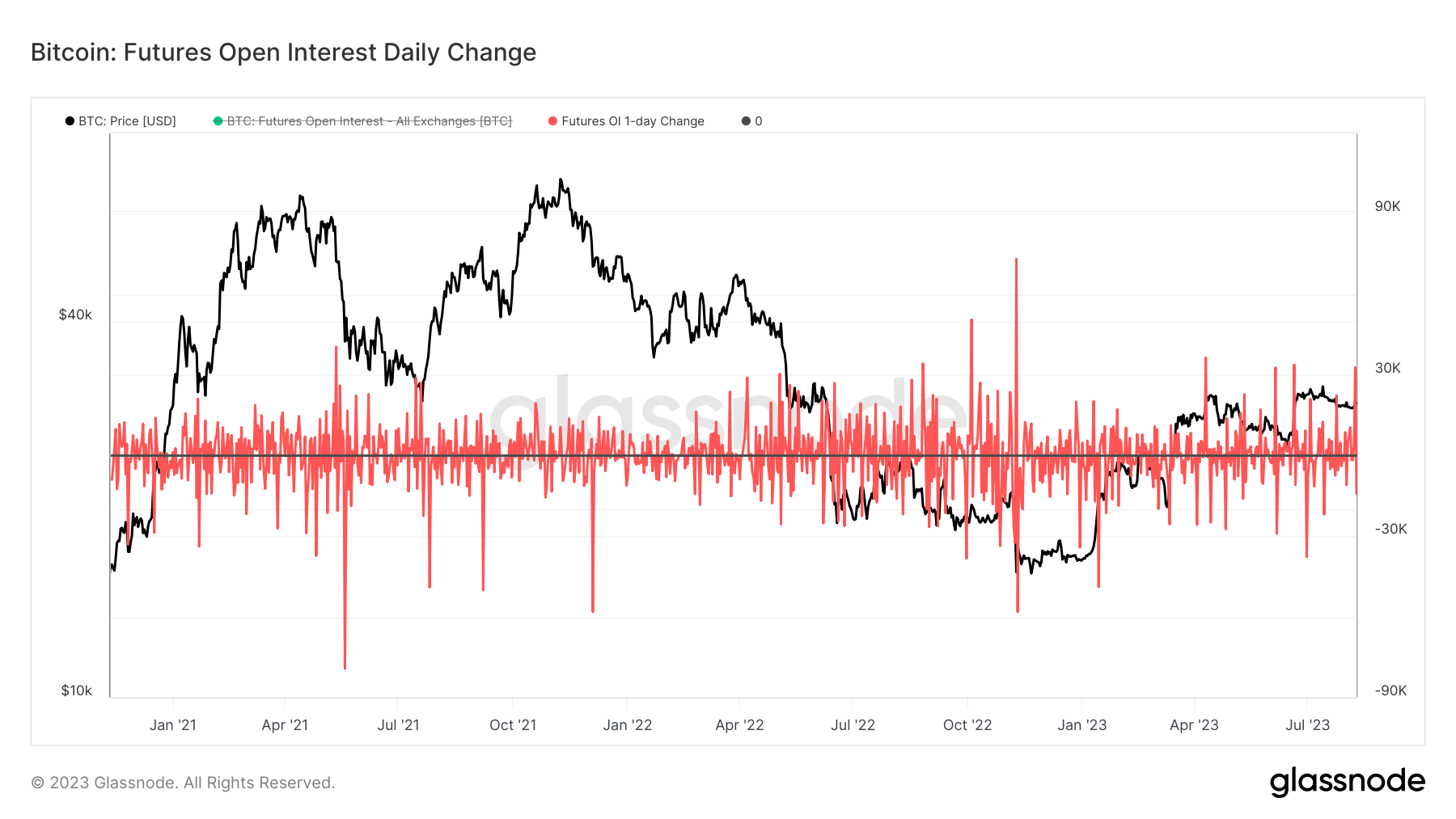

- A pointy enhance in futures open curiosity occurred on Aug. 9 to a degree seen simply seven occasions this halving cycle, thus registering one of many largest single-day surges ever.

- A powerful addition of over 32,000 Bitcoin was channeled into futures open curiosity contracts, pushing the open curiosity near the year-to-date highs.

- A pointy variation in Futures Open Curiosity typically signifies deleveraging occasions and liquidation cascades and might swing each methods – lengthy and quick.

- Vital optimistic spikes usually signify substantial inflows of Open Curiosity, hinting at recent capital venturing into the market and an upswing in leverage.

- Alternatively, giant unfavourable spikes normally emerge from quick/lengthy squeezes or liquidation cascades, which leads to an enormous quantity of open contracts being margin referred to as and closed.

The put up Bitcoin futures surge suggesting recent capital getting into market appeared first on CryptoSlate.

[ad_2]