[ad_1]

Fast Take

The US Federal Reserve’s latest coverage stance has had noticeable results on varied monetary belongings. The Fed maintained the fed funds charge at 5.25 – 5.50% on March 20 and signaled a slowed tempo of stability sheet discount.

In keeping with Zerohedge, Jerome Powell mentioned, “We didn’t make any selections right this moment. The overall sense of the committee is that it’ll be acceptable to sluggish the tempo of runoff pretty quickly, per the plans we beforehand issued.”

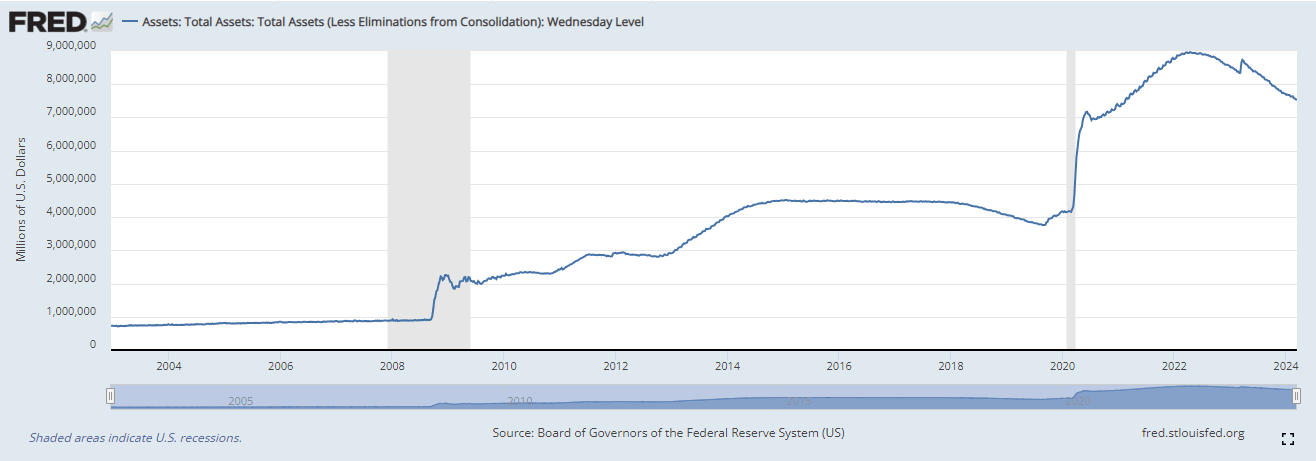

In keeping with FRED knowledge, the full belongings on the Federal Reserve’s stability sheet have reached $7.542 trillion, marking a slight improve from $7.538 trillion within the earlier week. The Federal Reserve’s stability sheet has expanded by roughly 59% in comparison with its dimension in January 2020.

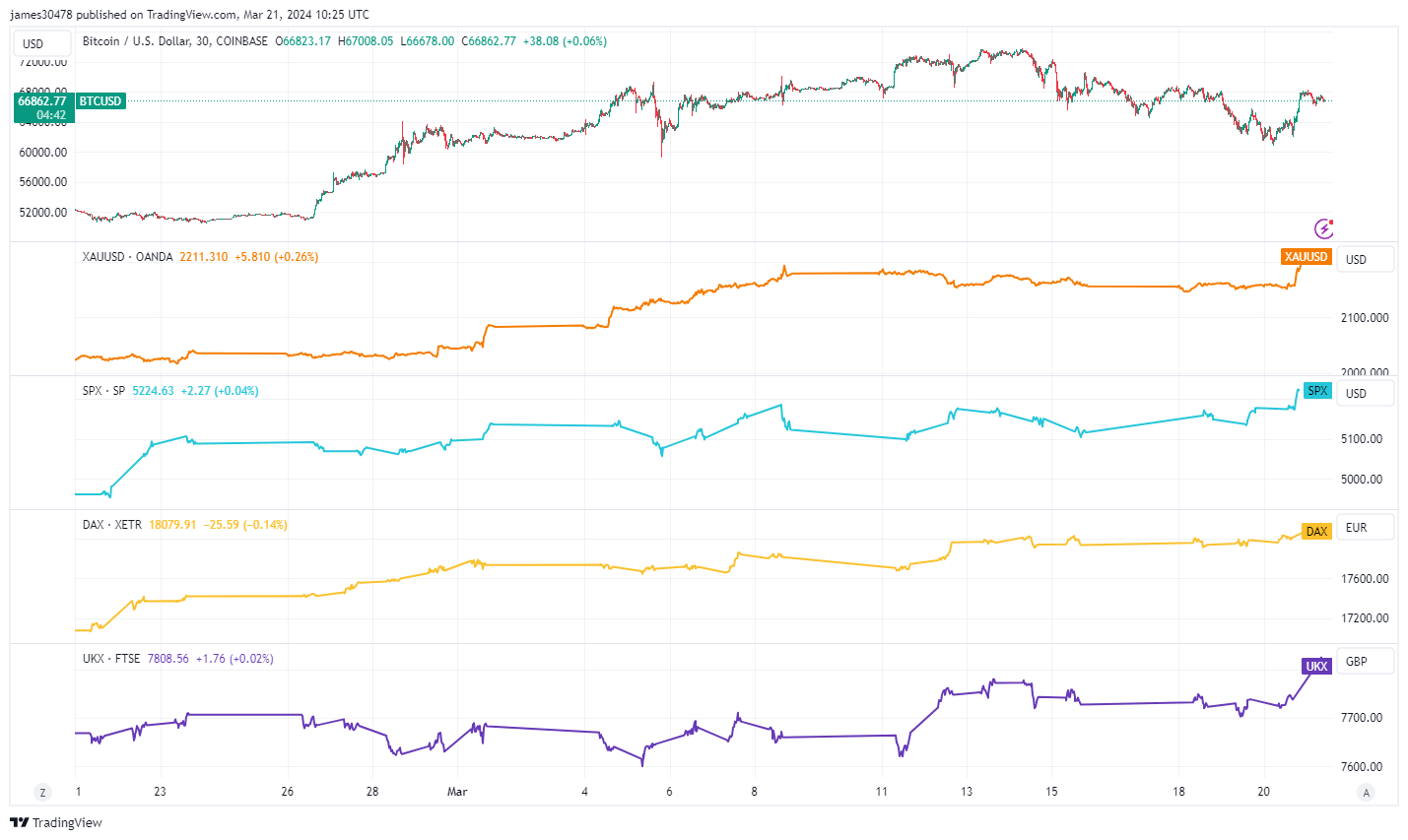

CryptoSlate reported Bitcoin’s important volatility on the day of the announcement, with costs oscillating between $60,800 and simply over $68,000. The impression prolonged past digital belongings, with Gold reaching contemporary peaks now buying and selling at $2,210 and the S&P 500 additionally hitting a file excessive at 5,224. As well as, European equities akin to DAX and the UK’s FTSE 100 continued their regular upward development.

In keeping with the CME Fed watch device, this response by the markets was mirrored by the 65% prediction of a Fed charge reduce in June.

Nevertheless, it’s pertinent to notice that these market actions happen amidst persistent inflationary pressures, with US CPI remaining above the two% goal since March 2021 and unemployment sustaining close to secular lows at 3.9%, in line with Buying and selling Economics. The Fed’s twin mandate to advertise most employment and value stability will stay a key level of focus within the coming months.

CryptoSlate has beforehand explored the potential for sustained inflation within the 2020s, drawing parallels to the inflationary pressures of the Seventies. Moreover, how Gold and Bitcoin could react favorably to such financial situations has been mentioned.

The submit Powell suggests slower Fed stability sheet discount, boosting Bitcoin and Gold appeared first on CryptoSlate.

[ad_2]